Related Link

Economists have carefully analyzed the recovery from global economic crisis, and have made very few recommendations and listed very few factors, if any. I have mentioned in an earlier blog that excessive regulation could be listed as a factor. In that sense, those controls, that try to make business more ethical, inhibited the ability to do business for some. Likewise, the mechanisms use to enhance security -not only in the USA- can be perceived as intimidating or even discriminatory for many individuals, affecting their ability to partake in economic activities or even being productively employed.

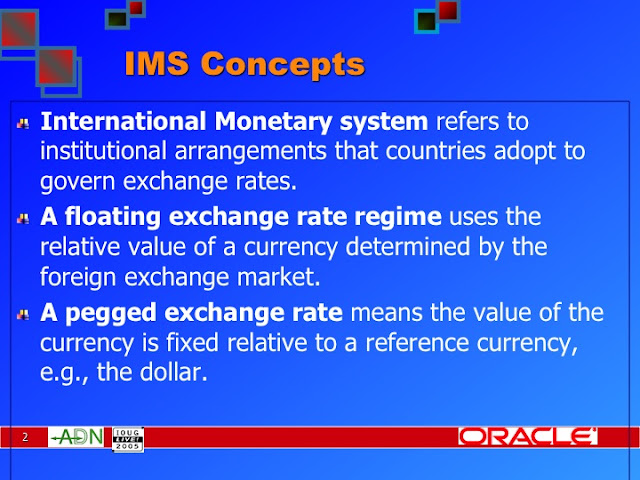

However, there are other factors. For instance, the instability of money exchange rates affects the economic balance resulting from the Euro crisis, caused systematically by the slow regional economic growth and the deficit due to the Greek default and other countries in need of a bail out. Similarly, Monetary regulations in China have not looked at the global impact and subsequent retro-impact not to maintain a stable money exchange with other countries.

Significantly so, since aggregate economics have acquired a more complex dimension doing business on the web, I have observed that there are a few main streams, and that they should converge as martingales that can be equated in an equilibrium point. Such it is possible to list the coins that are aligned with or pegged to the dollar and Euro, and those that are neither aligned nor pegged and are in constant adjustment in a protectionist fashion, which while normal, on excess could have critical consequences as the difficult financial times the world is living today.